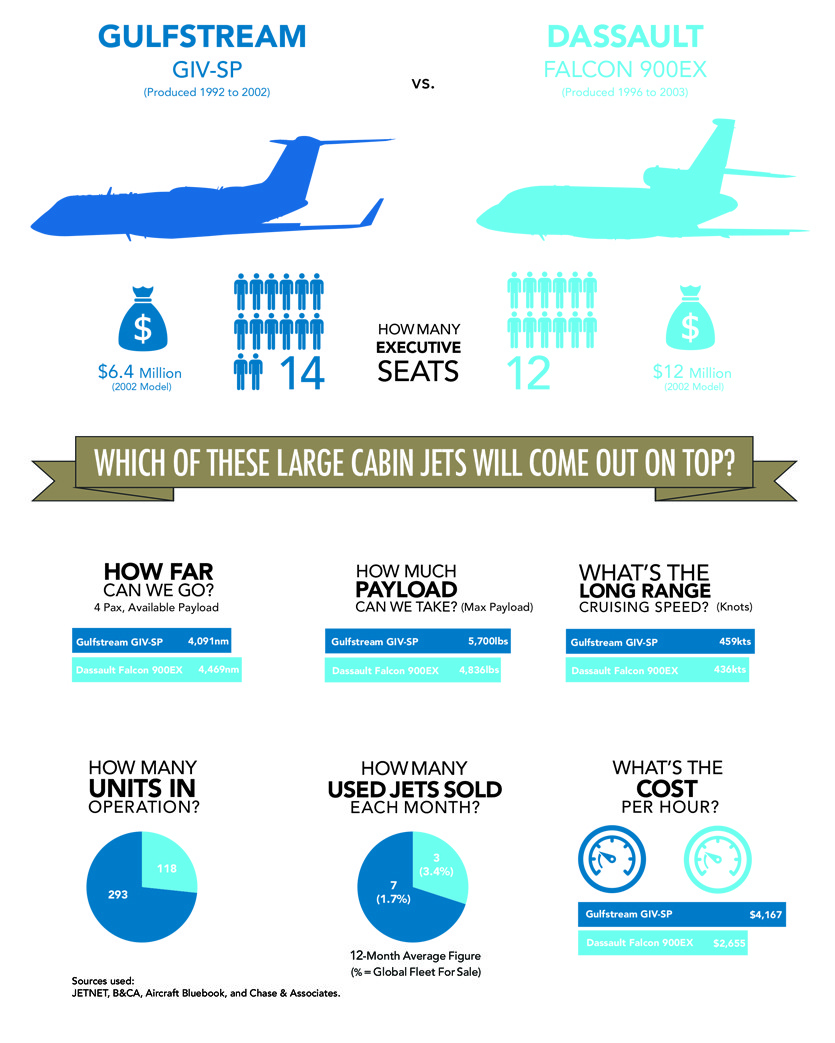

Over the following paragraphs we’ll consider key productivity parameters for the Gulfstream GIV-SP and Dassault Falcon 900EX (including payload, range, speed, and cabin size) to establish which aircraft provides the better value in the pre-owned Large Cabin business jet market.

Among the questions we’ll look to answer is why there has been such a large increase in pre-owned sales for the Gulfstream GIV-SP in the past 12 months? Discover more within this article.

Gulfstream GIV-SP

FAA certification of the original Gulfstream GIV was awarded in April 1987, and deliveries were made until September 1992 when the improved Gulfstream GIV-SP (‘SP’ denoting Special Performance) entered the market. The GIV-SP provided higher payload and landing weights, and improved payload-range performance compared to its predecessor.

It was subsequently made possible for owners of GIV models to upgrade their jets to GIV-SPs.

Built between 1992 and 2002, the Gulfstream GIV-SP proved to be a hit with the market, and 303 aircraft were built during the production run. As of this writing, 293 remained in service, and ten units had been retired. By continent, North America had the largest GIV-SP fleet percentage (87%), followed by Asia (6%) and Africa (4%), accounting for a 97% of the world’s fleet, per JETNET data.

Dassault Falcon 900EX

The first flight of the original Dassault Falcon 900 – a model developed from the Falcon 50 – took place in 1984. Over the years, Dassault refined and upgraded the original with the Falcon 900B, and eventually the Falcon 900EX, which offered improved engines and range over its predecessors, and an all-glass flight deck with modernized avionics.

Produced between 1996 and 2003 (before a further upgrade was introduced in the form of the Falcon 900EX EASy), Dassault built 118 Falcon 900EX business jets, all of which remained in operation at the time of writing.

By continent, North America had the largest fleet percentage (81%), followed by Europe (14%), accounting for a combined total of 95% of the world’s Falcon 900EX fleet, at the time of writing, per JETNET data.

Payload Comparison

When comparing business jets, an important area for potential operators to focus on is payload capability, and especially the ‘Available Payload with Maximum Fuel’. Table A shows the Gulfstream GIV-SP’s ‘Available Payload with Maximum Fuel’ is 2,419lbs, which is 948lbs more than that offered by the Dassault Falcon 900EX (1,471lbs).

Table A: Gulfstream GIV-SP vs Dassault Falcon 900EX Payload Comparison

Cabin Comparison

As shown in Chart A, the cabin height is the same for both aircraft. However, the cabin width is greater in the Dassault Falcon 900EX (7.7ft) compared to the Gulfstream GIV-SP (7.3ft). Not depicted on the chart, the Gulfstream GIV-SP offers more cabin length (45.1ft. versus 33.2ft), and provides more overall cabin volume (1,658cu.ft versus 1,270cu.ft).

Configured with executive seating, the Gulfstream GIV-SP provides room for up to 14 seats and two crew, while the Dassault Falcon 900EX provides room for 12 and two crew.

Moreover, the Gulfstream GIV-SP provides more internal luggage volume (169cu.ft) compared to the Falcon 900EX (127cu.ft). Neither jet provides any external luggage space.

Chart A: Gulfstream GIV-SP vs Dassault Falcon 900EX Cabin Comparison

Range Comparison

Using Wichita, Kansas, as the start point, Chart B shows the Dassault Falcon 900EX has a range of 4,469nm while carrying four passengers and available fuel. The Gulfstream GIV-SP provides a range of 4,091nm with the same payload.

Note: For business jets, ‘Four Pax Range’ represents the maximum IFR range of the aircraft at long range cruise. The NBAA IFR fuel reserve calculation is for a 200nm alternate. This range does not include winds aloft or any other weather-related obstacles.

Chart B: Gulfstream GIV-SP vs Dassault Falcon 900EX Range Comparison

Powerplant Details

The Gulfstream GIV-SP is powered by two Rolls-Royce Tay Mk611-8 engines, providing 13,850lbst each. These burn 520 gallons of fuel per hour. By comparison, the Dassault Falcon 900EX has three Honeywell TFE731-60 engines producing 5,000lbst each. These burn 303 gallons of per hour.

Cost per Mile Comparison

Chart C details ‘Cost per Mile’, comparing the two business jets and factoring direct costs, with each aircraft flying a 1,000nm mission with 800lbs (four passengers) payload.

The Gulfstream GIV-SP ($10.85/nm) has a highest variable cost compared to the Dassault Falcon 900EX ($6.69/nm) – a significant difference of 62.2% in favor of the Falcon 900EX.

Chart C: Gulfstream GIV-SP vs Dassault Falcon 900EX Cost Per Mile Comparison

Variable Cost Comparison

The ‘Variable Cost’, illustrated in Chart D, is defined as the estimated cost of fuel, maintenance, labor, scheduled parts, and miscellaneous trip expenses (e.g., hangar, crew, and catering). These costs DO NOT represent a direct source into every flight department and their trip support expenses.

For comparative purposes, the costs presented are the relative differences, not the actual differences since these may vary from one flight department to another.

The Gulfstream GIV-SP ($4,167/hr) has a higher variable cost compared to the Dassault Falcon 900EX ($2,655/hr) – a difference of 56.9% in favor of the Falcon 900EX.

Chart D: Gulfstream GIV-SP vs Dassault Falcon 900EX Variable Cost Comparison

Market Comparison

Table B contains the used 2002 prices (per Aircraft Bluebook) for the Gulfstream GIV-SP and the Dassault Falcon 900EX since this was the last year both models were in production. Notably, as of this writing, a 2002 model GIV-SP costs much less to purchase on average than a Falcon 900EX ($6.4m versus $12m).

Adding a further level of intrigue to the pre- owned prices is the fact that in 2002 the cost of a new Gulfstream GIV-SP was $32.75m – just $50k less than a $32.80m Dassault Falcon 900EX.

Also, listed are the long-range cruise speed and range numbers (per B&CA), while the number of aircraft in operation, the percentage for sale, and average sold are from JETNET. The average number of used transactions (units sold) per month over the previous 12 months were seven for the Gulfstream GIVSP, and three for the Falcon 900EX.

Table B: Gulfstream GIV-SP vs Dassault Falcon 900EX Market Comparison

Used Aircraft Retail Sale Transaction Trends

Current availability of used business jet inventory is a daily moving target. Comparing the 12 months ending May 2022, there were 82 pre-owned retail sale transactions for the Gulfstream GIV-SP. For comparison, in May 2021 there were 73, while the five-year average is 56.

The difference between the two 12-month periods (May 2022 and May 2021) is a relatively minimal nine jets. However, the difference compared to the five-year average is 26 additional jet sales in the year leading up to May 2022.

Where did the additional demand come from? In reviewing a detailed usage report from JETNET, we found the number of Gulfstream GIV-SP business jets used for charter operations increased from nine aircraft in May 2021 to 20 in May 2022.

It is reasonable to conclude that with many new users entering Business Aviation via charter, and with a shortage of newer inventory on the open market, charter operators have found the Gulfstream GIV-SP to be a very useful model to turn to – especially with its lower purchase price.

As of June 4, 2022, there were four Gulfstream GIV-SP jets available for sale, two had asking prices of $5m and $5.5m, one invited offers, and one was available for lease.

By comparison, there were five Dassault Falcon 900EX jets for sale – one had a sale pending, while the other four invited offers.

While each aircraft serial number is unique, the Airframe Total Time (AFTT) and age/condition will cause great variation in the price of a specific aircraft – even between two aircraft from the same year of manufacture. The final negotiated price remains to be decided between the seller and buyer before the sale of an aircraft is completed.

Maximum Scheduled Maintenance Equity

Chart E and Chart F display the Gulfstream GIV-SP and Dassault Falcon 900EX, respectively. They depict (and project) the Maximum Maintenance Equity each jet has available based on its age.

The Maximum Maintenance Equity figure was achieved the day an aircraft came off the production line (since it had not accumulated any utilization toward any maintenance events).

The percent of the Maximum Maintenance Equity that an average aircraft will have available, based on its age, assumes:

- Average annual utilization of 375 flight hours for the Gulfstream GIV-SP hours, and 475 flight hours for the Dassault Falcon 900EX; and

- All maintenance is completed when due.

The Gulfstream GIV-SP shows the highest average maximum equity of $3,234m. Though the Falcon 900EX shows a lower average maximum equity at $2,159m, however, it also shows a large percentage increase in Year 32 in terms of average maximum equity.

Depreciation Schedule

Aircraft that are owned and operated by US businesses are often depreciable for income tax purposes under the Modified Accelerated Cost Recovery System (MACRS). Under MACRS, taxpayers can use accelerated depreciation of assets by taking a greater percentage of the deductions during the first few years of the applicable recovery period.

In certain cases, aircraft may not qualify under the MACRS system and must be depreciated under the less favourable Alternative Depreciation System (ADS), based on a straight-line method meaning that equal deductions are taken during each year of the applicable recovery period. In most cases, recovery periods under ADS are longer than recovery periods available under MACRS.

There is a variety of factors that taxpayers must consider in determining if an aircraft may be depreciated, and, if so, the correct depreciation method and recovery period that should be utilized. For example, aircraft used in charter service (i.e. Part 135) are normally depreciated under MACRS over a seven-year recovery period, or under ADS using a twelve-year recovery period.

Aircraft used for qualified business purposes, such as Part 91 business use flights, are generally depreciated under MACRS over a period of five years or by using ADS with a seven-year recovery period. There are certain uses of the aircraft, such as non-business flights, that may have an impact on the allowable depreciation deduction available in any given year.

The US enacted the 2017 Tax Cuts & Jobs Act into law on December 22, 2017. Under the Act, taxpayers may be able to deduct up to 100% of the cost of a new or pre-owned aircraft purchased and placed in service before January 1, 2023.

This 100% expensing provision is a huge bonus for aircraft owners and operators. After December 31, 2022, the Act decreases the percentage available each year by 20% to depreciate qualified business jets until December 31, 2026.

Table C depicts an example of using the MACRS schedule for a 2002-model Gulfstream GIV-SP in private (Part 91) and charter (Part 135) operations over five- and seven-year periods. The price is as published by Aircraft Bluebook at the time of writing.

Table C: Gulfstream GIV-SP Sample Tax Depreciation Schedule

Table D depicts an example of using the MACRS schedule for a 2002-model Dassault Falcon 900EX in private (Part 91) and charter (Part 135) operations over five- and seven-year periods. The price is as published by Aircraft Bluebook at the time of writing.

Table D: Dassault Falcon 900EX Sample Tax Depreciation Schedule

Productivity Comparison

The points in Chart G are centered on the same aircraft. Pricing used in the horizontal axis is as published in Aircraft Bluebook (2002 models). The productivity index requires further discussion since factors used can be somewhat arbitrary. Productivity can be defined (and it is here) as the multiple of three factors:

1. Four Passenger Range (nm) with available fuel

2. The long-range cruise speed flown to achieve that range

3. The cabin volume available for passengers and amenities

Others may choose different parameters, but serious business aircraft buyers are usually impressed with price, range, speed, and cabin size.

Chart G: Gulfstream GIV-SP vs Dassault Falcon 900EX Productivity Comparison

The Gulfstream GIV-SP offers greater ‘Available Payload with Maximum Fuel’, a larger cabin volume, and a higher cruise speed than the Dassault Falcon 900EX, which has a longer range, and has lower operating costs.

The biggest differentiator, according to Aircraft Bluebook, is the pre-owned cost to acquire the aircraft, with a 2002 model GIV-SP costing $6.4m versus $12m for a 2002 model Falcon 900EX (at the time of writing).

Within these paragraphs we have touched upon several of the attributes that business jet operators value, although there are other qualities, such as airport performance, terminal area performance and time-to-climb that might factor in a buying decision.

Prospective buyers of one of these large business jets would have to weigh the capabilities of each very carefully against their specific mission need to determine which one is the best fit for their flight operations, but we believe the higher sales volume for the GIV-SP over the past two years is a reflection of the market finding an older model offering excellent value at its current price-point.

Find Gulfstream IV-SP and Dassault Falcon Large Jets for sale on AvBuyer.