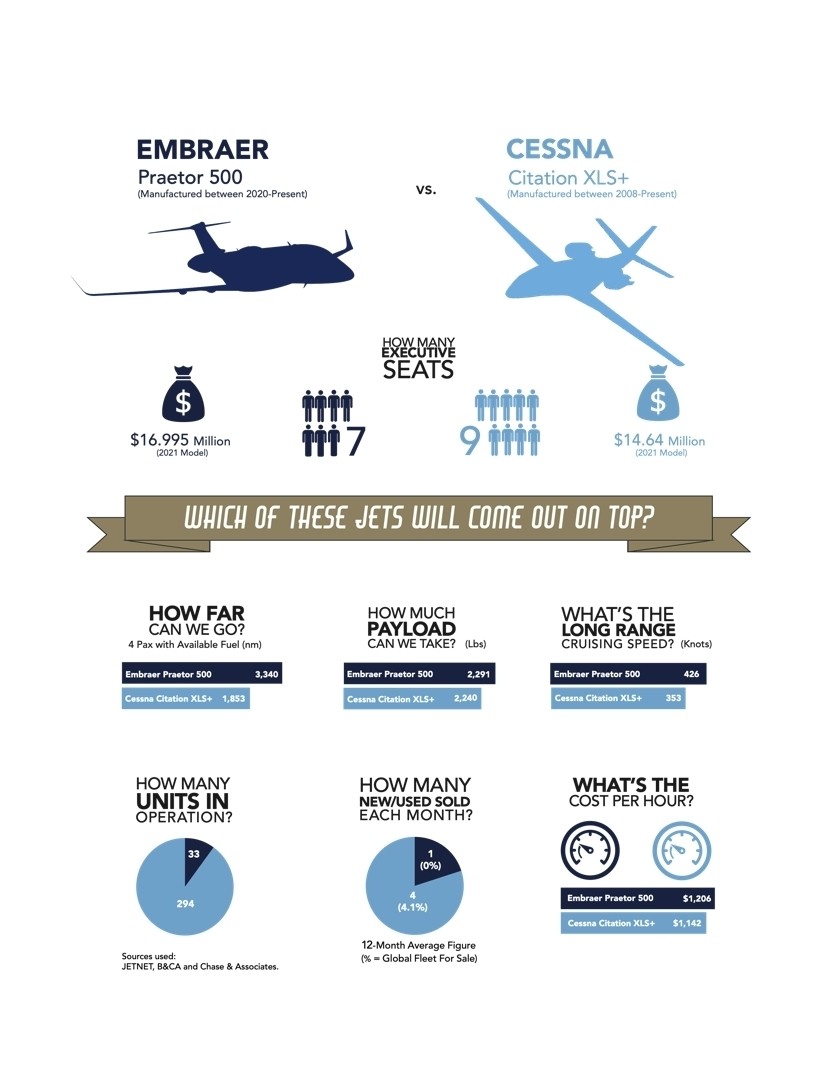

Over the following paragraphs we’ll consider some of the key productivity parameters for the Embraer Praetor 500 jet and the Cessna Citation XLS+ (including payload, range, speed, and cabin size) to establish which aircraft provides the better value in the business jet market, and to whom.

Although these two models do not directly compete in the market, we will take a slightly different approach with this month’s analysis. Accounting for the new pricing of the two featured jets, how much additional range, speed and cabin volume would an extra $2.36m purchase?

The goal is to provide some food for thought to those assessing their move-up prospects within the Mid-Size Jet market.

Embraer Praetor 500

From among the aircraft forming the ‘next rung’ on the business jet ladder to the Citation XLS+, the Embraer Praetor 500 is very competitively priced. Announced in 2016, the Praetor 500 replaced the Legacy 450 on Embraer’s production line.

The Praetor 500 is powered by twin Honeywell HTF 7500E turbofans with 6,500 pounds thrust each, and it offers a four-passenger NBAA IFR range of 3,250 nautical miles.

Addition of an extra fuel tank, and turbulence-reduction technology, account for the Praetor 500’s 350nm range advantage over its Legacy 450 predecessor. The Praetor 500 is capable of flying from the US West Coast to Europe with a single stop en route.

At the time of writing, there were 34 Embraer Praetor 500 business jets in operation worldwide, with two in shared-, and 10 in fractional ownership. Over 80% of the Praetor 500 fleet was based in the US.

Cessna Citation XLS+

The Cessna Citation XLS+ received FAA certification in 2008, and is an improved version of the already-successful Citation XLS. Among its improvements, it features better performance through upgraded Pratt & Whitney PW545C engines and FADEC controls.

The Citation XLS+ forms today’s entry-point into Mid-Size Jet ownership. It can transport four passengers 1,853 nautical miles, taking-off from runways as short as 3,560 feet. Since deliveries began, the Citation XLS+, like its predecessor, has been a success on the market.

At the time of writing, there were 297 Cessna Citation XLS+ business jets in operation worldwide, eight of which were under shared ownership arrangements. Three more aircraft had been retired. Geographically speaking, 61% of the Citation XLS+ fleet was based in the US.

How much do the jets cost?

Cessna Citation XLS+

$14.64 m

Embraer Praetor 500

$16.995 m

Cessna Citation XLS+

2,240 lbs

Embraer Praetor 500

2,291 lbs

Cessna Citation XLS+

1,853 nm

Embraer Praetor 500

3,340 nm

What's the long range cruising speed

Cessna Citation XLS+

353 knots

Embraer Praetor 500

426 knots

Cessna Citation XLS+

US$1,142

Embraer Praetor 500

US$1,206

Over the following paragraphs we’ll consider some of the key productivity parameters for the Embraer Praetor 500 and the Cessna Citation XLS+ (including payload, range, speed, and cabin size) to establish which aircraft provides the better value in the business jet market, and to whom.

Although these two models do not directly compete in the market, we will take a slightly different approach with this month’s analysis. Accounting for the new pricing of the two featured jets, how much additional range, speed and cabin volume would an extra $2.36m purchase?

The goal is to provide some food for thought to those assessing their move-up prospects within the Mid-Size Jet market.

Embraer Praetor 500

From among the aircraft forming the ‘next rung’ on the business jet ladder to the Citation XLS+, the Embraer Praetor 500 is very competitively priced within the Mid-size Jet market. Announced in 2016, the Praetor 500 replaced the Legacy 450 on Embraer’s production line.

The Praetor 500 is powered by twin Honeywell HTF 7500E turbofans with 6,500 pounds thrust each, and it offers a four-passenger NBAA IFR range of 3,250 nautical miles.

Addition of an extra fuel tank, and turbulence-reduction technology, account for the Praetor 500’s 350nm range advantage over its Legacy 450 predecessor. The Praetor 500 is capable of flying from the US West Coast to Europe with a single stop en route.

At the time of writing, there were 34 Embraer Praetor 500 business jets in operation worldwide, with two in shared-, and 10 in fractional ownership. Over 80% of the Praetor 500 fleet was based in the US.

Cessna Citation XLS+

The Cessna Citation XLS+ received FAA certification in 2008, and is an improved version of the already-successful Citation XLS. Among its improvements, it features better performance through upgraded Pratt & Whitney PW545C engines and FADEC controls.

The Citation XLS+ forms today’s entry-point into Mid-Size Jet ownership. It can transport four passengers 1,853 nautical miles, taking-off from runways as short as 3,560 feet. Since deliveries began, the Citation XLS+, like its predecessor, has been a success on the market.

At the time of writing, there were 297 Cessna Citation XLS+ business jets in operation worldwide, eight of which were under shared ownership arrangements. Three more aircraft had been retired. Geographically speaking, 61% of the Citation XLS+ fleet was based in the US.

Payload & Range Comparison

When comparing business jets, an important area for potential operators to focus on is payload capability, and especially the ‘Available Payload with Maximum Fuel’. Table A shows the Praetor 500 ‘Available Payload with Maximum Fuel’ to be 1,610lbs, which is double the 800lbs offered by the Citation XLS+.

Table A: Embraer Praetor 500 vs Cessna Citation XLS+ Payload Comparison

Cabin Comparison

The Embraer Praetor 500 has more cabin height than the Cessna Citation XLS+ (6.0ft. vs. 5.7ft); more width (6.8ft vs 5.5ft); and greater length (20.6ft vs 18.5ft). Moreover, the Praetor 500 offers a flat floor cabin, as illustrated in Chart A. The overall cabin volume is 705 cu.ft. vs. 461 cu.ft. in favor of the Praetor 500.

Chart A: Embraer Praetor 500 vs Cessna Citation XLS+ Cabin Comparison

The Praetor 500 also provides more luggage volume (40 cu.ft. internal and 110 cu.ft. external) than the Citation XLS+ (10 cu.ft. internal and 80 cu.ft. external). It is worth noting, however, that despite its smaller cabin volume, the Citation XLS+ provides a higher seating capacity (nine vs. seven in executive configuration, per B&CA).

Range Comparison

Using Wichita airport in Wichita, Kansas as the start point, Chart B shows the Embraer Praetor 500 has a range of 3,340nm with four passengers and available fuel, which is considerably greater than the Citation XLS+ at 1,853nm. This difference is 1,487nm in favor of the Praetor 500, and shows the variation in capabilities within the Mid-Size Jet segment.

Chart B: Embraer Praetor 500 vs Cessna Citation XLS+ Range Comparison

Note: For business jets, ‘Four Pax Range’ represents the maximum IFR range of the aircraft at long range cruise. The NBAA IFR fuel reserve calculation is for a 200nm alternate. This range does not include winds aloft or any other weather-related obstacles.

Powerplant Details

As mentioned previously, the Praetor 500 has two Honeywell HTF7500E engines, providing 6,540lbst each. These burn 241 gallons of fuel/hour (gal/hr). By comparison, the Citation XLS+ has two Pratt & Whitney PW308C engines producing 5,000lbst each. These burn 196gal/hr.

Cost per Mile Comparison

Chart C details ‘Cost per Mile’, comparing the Embraer Praetor 500 and Cessna Citation XLS+, factoring direct costs and with both aircraft flying a 1,000nm mission with an 800lbs (four passengers) payload.

The Citation XLS+ has the lower cost per mile at $3.69 per nautical mile – 48 cents, or 11.5% less to operate than the Praetor 500 ($4.17 per nautical mile).

Chart C: Embraer Praetor 500 vs Cessna Citation XLS+ Cost Per Mile Comparison

Variable Cost Comparison

The ‘Variable Cost’, illustrated in Chart D, is defined as the estimated cost of fuel, maintenance labor, scheduled parts, and miscellaneous trip expenses (e.g., hangar, crew, and catering). These costs DO NOT represent a direct source into every flight department and their trip support expenses.

For comparative purposes, the costs presented are the relative differences, not the actual differences, since these may vary from one flight department to another. The Citation XLS+ ($1,142/hr) has a 5.3% lower variable cost than the Embraer Praetor 500 ($1,206/hr).

Chart D: Embraer Praetor 500 vs Cessna Citation XLS+ Variable Cost Comparison

Aircraft Comparison Table

Table B contains the new prices (per B&CA) for the Embraer Praetor 500 and Cessna Citation XLS+ ($16.995m and $14.640m, respectively). This is a difference of $2.355m. Also, listed are the long-range cruise speed and range numbers (also per B&CA), while the number of aircraft in-operation, the percentage for sale, and average sold are from JETNET.

Table B: Embraer Praetor 500 vs Cessna Citation XLS+ Market Comparison

At the time of writing, the Embraer Praetor 500 had no aircraft ‘for sale’ on the used aircraft market. By comparison, there were twelve Citation XLS+ jets for sale, or a total 4.1% of the fleet ‘for sale’. The average number of new/used transactions (units sold) per month over the previous 12 months was one for the Praetor 500 and four for the Citation XLS+.

Maximum Scheduled Maintenance Equity

Chart E depicts (and projects) the Maximum Maintenance Equity that the Cessna Citation XLS+ has available, based on its age, and is courtesy of Asset Insight. At the time of writing, similar information was unavailable for the Praetor 500 model.

- The Maximum Maintenance Equity figure is achieved the day the aircraft comes off the production line, since it has not accumulated any utilization toward any maintenance events.

- The percent of the Maximum Maintenance Equity that an average aircraft will have available, based on its age, assumes:

- Average annual utilization of 375 flight hours

- All maintenance is completed when it’s due.

Chart E: Maximum Scheduled Maintenance Equity (Cessna Citation XLS+)

Depreciation Schedule

Aircraft that are owned and operated by businesses are often depreciable for income tax purposes under the Modified Accelerated Cost Recovery System (MACRS). Under MACRS, taxpayers can use accelerated depreciation of assets by taking a greater percentage of the deductions during the first few years of the applicable recovery period.

In certain cases, aircraft may not qualify under the MACRS system and must be depreciated under the less favorable Alternative Depreciation System (ADS), based on a straight-line method, meaning that equal deductions are taken during each year of the applicable recovery period. In most cases, recovery periods under ADS are longer than recovery periods available under MACRS.

There is a variety of factors that taxpayers must consider in determining if an aircraft may be depreciated, and, if so, the correct depreciation method and recovery period that should be utilized. For example, aircraft used in charter service (i.e., Part 135) are normally depreciated under MACRS over a seven-year recovery period, or under ADS using a twelve-year recovery period.

Aircraft used for qualified business purposes, such as Part 91 business use flights, are generally depreciated under MACRS over a period of five years or by using ADS with a seven-year recovery period. There are certain uses of the aircraft, such as non-business flights, that may have an impact on the allowable depreciation deduction available in any given year.

The US enacted the 2017 Tax Cuts & Jobs Act into law on December 22, 2017. Under the Act, taxpayers may be able to deduct up to 100% of the cost of a new or pre-owned aircraft purchased and placed in service before January 1, 2023.

This 100% expensing provision is a huge bonus for aircraft owners and operators. After December 31, 2022, the Act decreases the percentage available each year by 20% to depreciate qualified business jets until December 31, 2026.

Table C depicts an example of using the MACRS schedule for a 2021- model Embraer Praetor 500 placed in private (Part 91) and charter (Part 135) operations over five- and seven-year periods, respectively. The price is as published by B&CA at the time of writing.

Table C: 2021-Model Embraer Praetor 500 Sample Tax Depreciation Schedule

Table D, meanwhile, depicts an example of using the MACRS schedule for a 2021-edition Cessna Citation XLS+ in private (Part 91) and charter (Part 135) operations over five- and seven-year periods.

Table D: 2021-Model Cessna Citation XLS+ Sample Tax Depreciation Schedule

Asking Prices & Quantity

At the time of writing, there were no Embraer Praetor 500 business jets available for sale on the used aircraft market. However, there were 12 Cessna Citation XLS+ available for sale on the used market, with asking prices ranging from $5.25m to $8.9m.

While each aircraft serial number is unique, the Airframe Total Time (AFTT) and age/condition will cause great variation in the price of a specific aircraft – even between two aircraft from the same year of manufacture.

The final negotiated price remains to be decided between the seller and buyer before the sale of an aircraft is completed.

Productivity Comparison

The points in Chart F are centered on the same aircraft. Pricing used in the horizontal axis is as published in B&CA. The productivity index requires further discussion since factors used can be somewhat arbitrary. Productivity can be defined (and it is here) as the multiple of three factors:

- Four Passenger Range (nm) with available fuel;

- The long-range cruise speed flown to achieve that range;

- The cabin volume available for passengers and amenities.

Others may choose different parameters, but serious business aircraft buyers are usually impressed with price, range, speed, and cabin size.

Chart F includes our two study business jets, plus the Cessna Citation Latitude and Longitude, as well as the Embraer Praetor 600 as other examples of suitable move-up aircraft from the Citation XLS+.

Chart F: Embraer Praetor 500 vs Cessna Citation XLS+ Productivity Comparison

As demonstrated, an extra $2.35m can buy more speed and cabin volume, longer range, and greater ‘Available Payload with Maximum Fuel’, in the case of the Embraer Praetor 500. But that performance increase will come with greater operating costs – in this case, the Citation XLS+ has 5.3% less variable operating cost per hour, and 11.5% lower cost per mile compared to the Praetor 500.

The additional aircraft within the Productivity Chart demonstrate the Cessna Citation Latitude is another attractive step-up option for Citation XLS+ operators, though its overall productivity index rating is lower than the Praetor 500’s, and it comes at a slightly higher price new.

Meanwhile, operators with a budget of between $20m-$30m may consider the even greater productivity offered by the Super Mid-Size Jets, including (but not limited to) the Citation Longitude and Praetor 600.

Which jet makes the most logical step-up platform for a Citation XLS+ operator? Prospective buyers would have to weigh the capabilities of each jet very carefully against their specific mission need to determine which one is the best fit for their flight operations.

A further consideration will come into play once aircraft like the Praetor 500 and 600, and Citation Longitude, build a track record in the pre-owned market, and it is clear how each depreciates with age.

Within these paragraphs we have touched upon several of the attributes that business jet operators value, although there are other qualities, such as airport performance, terminal area performance and time-to-climb that might factor in a buying decision.

Ultimately, there is plenty for a prospective buyer to consider when deciding which performance criteria matters most to them in an aircraft. Both business jets offer great value in the market today, providing they meet the requirements of the vast majority of an operator’s mission needs.

Once that percentage starts to deteriorate, however, it will be time for the owner/operator to assess a suitable replacement jet with the help of a professional who can offer insights far beyond the scope of this article.

Find Embraer mid-size jets and Cessna Citation XLS+ jets for sale on AvBuyer.