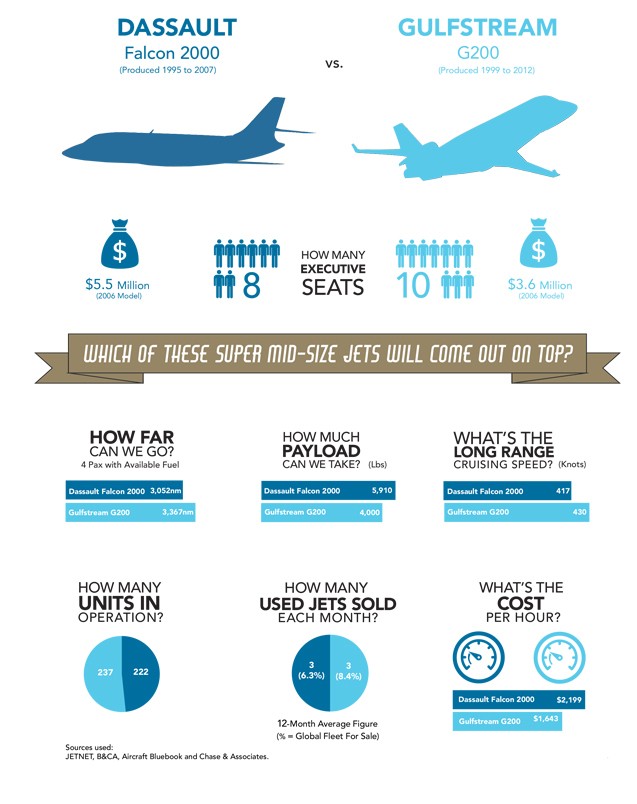

In this month’s Aircraft Comparative Analysis, Mike Chase provides information on a pair of popular pre-owned Super Mid-Size business jets. How will the Dassault Falcon 2000 jet compare with the Gulfstream G200?

Over the following paragraphs, we’ll analyse the performance of the Dassault Falcon 2000 and Gulfstream G200 to see how they compare in the market. We’ll consider productivity parameters (including payload, range, speed, and cabin size), and give consideration to their current market values.

Accounting for the used pricing of the two featured jets, how much additional range, speed, and cabin volume would an extra $1.9m purchase? This is one of the questions we will seek to answer…

Dassault Falcon 2000

Dassault originally introduced the Falcon 2000 as the Falcon X in 1989. First flight came four years later in 1993, and the aircraft entered service in 1995.

The twin-engine Falcon 2000 is a slightly smaller development of the Falcon 900 tri-jet, with transcontinental range. It features a large stand-up cabin, General Electric CFE738-1-1B engines, and a Collins Pro Line 4 integrated avionics suite.

At the time of writing, there were 221 Dassault Falcon 2000 business jets in operation worldwide, seven of which were in shared ownership arrangements, and five in fractional ownership programs. Ten aircraft have been retired. Geographically, 80% of the Falcon 2000 fleet is based in the US.

Gulfstream G200

The IAI 1126 Galaxy first flew on Christmas Day, 1997, and deliveries began in 1999. Powered by a pair of 5,700lbst Pratt & Whitney Canada PW306 powerplants, this model was designed to seat 8 to 10 passengers in a stand-up cabin.

In May, 2001 General Dynamics (GD) announced the acquisition of Galaxy Aerospace from Israel Aerospace Company (IAI) which included the type certificates for the entire family of aircraft. When the deal closed, GD placed the family of aircraft with Gulfstream, renaming the IAI 1126 Galaxy the Gulfstream G200.

Ten years later, the final G200 rolled off the production line in 2011, after 250 units had been built. The Gulfstream G280 replaced it, with deliveries beginning in 2012.

At the time of writing, there were 237 Gulfstream G200 business jets in operation worldwide, 14 of which were in shared ownership arrangements. Thirteen G200s have been retired. Geographically, 76% of the Gulfstream G200 fleet is based in the US.

How much do the jets cost?

Dassault Falcon 2000

$5.5 m

Dassault Falcon 2000

5,910 lbs

Gulfstream G200

4,000 lbs

Dassault Falcon 2000

3,052 nm

What's the long range cruising speed

Dassault Falcon 2000

417 knots

Gulfstream G200

430 knots

Dassault Falcon 2000

US$2,199

Over the following paragraphs, we’ll analyse the performance of the Dassault Falcon 2000 and Gulfstream G200 to see how they compare in the market. We’ll consider productivity parameters (including payload, range, speed, and cabin size), and give consideration to their current market values.

Accounting for the used pricing of the two featured jets, how much additional range, speed, and cabin volume would an extra $1.9m purchase? This is one of the questions we will seek to answer…

Dassault Falcon 2000

Dassault originally introduced the Falcon 2000 as the Falcon X in 1989. First flight came four years later in 1993, and the aircraft entered service in 1995.

The twin-engine Falcon 2000 is a slightly smaller development of the Falcon 900 tri-jet, with transcontinental range. It features a large stand-up cabin, General Electric CFE738-1-1B engines, and a Collins Pro Line 4 integrated avionics suite.

At the time of writing, there were 221 Dassault Falcon 2000 business jets in operation worldwide, seven of which were in shared ownership arrangements, and five in fractional ownership programs. Ten aircraft have been retired. Geographically, 80% of the Falcon 2000 fleet is based in the US.

Gulfstream G200

The IAI 1126 Galaxy first flew on Christmas Day, 1997, and deliveries began in 1999. Powered by a pair of 5,700lbst Pratt & Whitney Canada PW306 powerplants, this model was designed to seat 8 to 10 passengers in a stand-up cabin.

In May, 2001 General Dynamics (GD) announced the acquisition of Galaxy Aerospace from Israel Aerospace Company (IAI) which included the type certificates for the entire family of aircraft. When the deal closed, GD placed the family of aircraft with Gulfstream, renaming the IAI 1126 Galaxy the Gulfstream G200.

Ten years later, the final G200 rolled off the production line in 2011, after 250 units had been built. The Gulfstream G280 replaced it, with deliveries beginning in 2012.

At the time of writing, there were 237 Gulfstream G200 business jets in operation worldwide, 14 of which were in shared ownership arrangements. Thirteen G200s have been retired. Geographically, 76% of the Gulfstream G200 fleet is based in the US.

Payload Comparison

A potential operator should focus on payload capability as a key factor, as depicted in Table A. The Falcon 2000’s ‘Available payload with Maximum Fuel’ (1,096lbs) is significantly more than that offered by the Gulfstream G200 (600lbs).

TABLE A: Dassault Falcon 2000 vs Gulfstream G200 Payload Comparison

Cabin Cross Section Comparison

The Falcon 2000’s cabin volume is 1,028cu.ft. By comparison, the Gulfstream G200 has less cabin volume, at 868 cu.ft. Chart A, courtesy of UPCAST JETBOOK, offers a cabin cross-section comparison and shows the Falcon 2000 has more width than the Gulfstream G200 (7.7 ft. vs 7.2 ft.), but marginally less cabin height (6.2 ft. vs 6.25 ft). However, the Falcon 2000 cabin offers a flat floor design, unlike the Gulfstream G200.

CHART A: Dassault Falcon 2000 vs Gulfstream G200 Cabin Cross-Section Comparison

Not depicted in the chart, the Falcon 2000’s cabin length is greater at 31.2ft, compared to 24.5ft aboard the G200. Meanwhile, the Falcon 2000 provides less luggage volume (with no space internally, and 134 cu.ft. externally) compared to the Gulfstream G200 (25 cu.ft. internally, and 125 cu.ft. externally).

It’s worth noting that despite its smaller cabin volume, the Gulfstream G200 provides a higher seating capacity (ten vs. eight in executive configuration).

Range Comparison

Chart B, using Wichita, Kansas, as the origin point, shows that the Falcon 2000 offers less range coverage than the Gulfstream G200 (3,052nm vs 3,367nm), with both aircraft carrying four passengers and available fuel. Both jets can cover all of North and Central America, reaching into parts of South America.

CHART B: Dassault Falcon 2000 vs Gulfstream G200 Range Comparison

Note: For business jets, ‘Four Pax Range’ represents the maximum IFR range of the aircraft at long range cruise. The NBAA IFR fuel reserve calculation is for a 200nm alternate. This range does not include winds aloft or any other weather-related obstacles.

Cost Per Mile Comparison

Chart C details ‘Cost per Mile’ and compares the Falcon 2000 to the G200, factoring direct costs and with each aircraft flying a 1,000nm mission with an 800lbs (four passengers) payload.

CHART C: Dassault Falcon 2000 vs Gulfstream G200 Cost Per Mile Comparison

The Gulfstream G200 shows the lowest cost per nautical mile at $4.52 compared to $5.81 for the Falcon 2000 – a difference of $1.29 (22.2%) in favor of the Gulfstream G200.

Total Variable Cost

The ‘Total Variable Cost’ illustrated in Chart D is defined as the Cost of Fuel Expense, Maintenance Labor Expense, Scheduled Parts Expense and Miscellaneous Trip Expense. The Total Variable Cost for the Falcon 2000 computes at $2,199 per hour, which is significantly greater than the Gulfstream G200 at $1,643 per hour.

CHART D: Dassault Falcon 2000 vs Gulfstream G200 Total Variable Cost Comparison

Market Comparisons

Table B contains the pre-owned prices from Aircraft Bluebook for each aircraft. The average speed, cabin volume and maximum payload values are from B&CA, while the number of aircraft in-operation and percentage ‘For Sale’ are as reported by JETNET.

TABLE B: Dassault Falcon 2000 vs Gulfstream G200 Market Comparison

The Falcon 2000 has 6.3% of its fleet currently ‘For Sale’, while 8.4% of the Gulfstream G200 is on the market. The average number of pre-owned transactions (sold) per month for the Falcon 2000 and Gulfstream G200 is three units each.

The year 2006 was the last year that the Falcon 2000 was built and should provide a good basis for pre-owned comparison. As shown in Table B, there is a difference of $1.9m between the price of a 2006 model Falcon 2000 ($5.5m) and a 2006 model G200 ($3.6m).

Future Residual Values Projection

Meanwhile, Chart E displays current and future residual value for the next five years (from the time of writing), courtesy of Asset Insight, LLC.

While both the Gulfstream G200 and Dassault Falcon 2000 jets show declining future residual values, the Falcon 2000 is projected to depreciate by $2.417m (39.7%), while the Gulfstream G200 is expected to depreciate by $1.657m (40.9%).

CHART E: Dassault Falcon 2000 vs Gulfstream G200 Projected Market Values

Asking Prices & Quantity

The current used jet market for the Dassault Falcon 2000 shows a total of 15 aircraft ‘For Sale’, with six displaying an asking price ranging from $2.695m to $7.6m. We also reviewed the used Gulfstream G200 market and found 14 aircraft ‘For Sale’, with three displaying asking prices ranging between $2.695m and $6.695m.

Chart F shows the current Market Price ranges for both business jets, with the data being sourced from JETNET. While each serial number is unique, the Airframe (AFTT) hours and age/condition will cause great variations in price. Of course, the final negotiated price remains to be decided between the seller and buyer before the sale of an aircraft is completed.

CHART F: Dassault Falcon 2000 vs Gulfstream G200 Market Price Range Comparison

Depreciation Schedule

Aircraft that are owned and operated by businesses are often depreciable for income tax purposes under the Modified Accelerated Cost Recovery System (MACRS). Under MACRS, taxpayers are allowed to accelerate the depreciation of assets by taking a greater percentage of the deductions during the first few years of the applicable recovery period.

In certain cases, aircraft may not qualify under the MACRS system and must be depreciated under the less favourable Alternative Depreciation System (ADS) where depreciation is based on a straight-line method, meaning that equal deductions are taken during each year of the applicable recovery period. In most cases, recovery periods under ADS are longer than recovery periods available under MACRS.

There are a variety of factors that taxpayers must consider in determining if an aircraft may be depreciated, and if so, the correct depreciation method and recovery period that should be utilized. For example, aircraft used in charter service (i.e. Part 135) are normally depreciated under MACRS over a seven-year recovery period or under ADS using a twelve-year recovery period.

Aircraft used for qualified business purposes, such as Part 91 business use flights, are generally depreciated under MACRS over a period of five years or by using ADS with a six-year recovery period.

There are certain uses of the aircraft, such as non-business flights, that may have an impact on the allowable depreciation deduction available in a given year.

Table C depicts an example of using the MACRS schedule for a 2006-model Dassault Falcon 2000 business jet in private (Part 91) and charter (Part 135) operations over five- and seven-year periods, assuming a used retail price of $5.5m, per Aircraft Bluebook Autumn 2021 data.

TABLE C: Dassault Falcon 2000 MACRS Tax Depreciation Schedule

Table D depicts an example of using the MACRS schedule for a 2006- model Gulfstream G200 business jet in private (Part 91) and charter (Part 135) operations over five- and seven-year periods, assuming a used retail price of $3.6m, per Aircraft Bluebook Autumn 2021 data.

TABLE D: Gulfstream G200 MACRS Tax Depreciation Schedule

Productivity Comparisons

The points in Chart G are centered on the same aircraft. Pricing used in the vertical axis is as published in the Aircraft Bluebook Autumn 2021 data. The productivity index requires further discussion in that the factors used can be somewhat arbitrary. Productivity can be defined (and it is here) as the multiple of three factors:

- Range with full payload and available fuel

- The long-range cruise speed flown to achieve that range

- The cabin volume available for passengers and amenities.

Others may choose different parameters, but serious business aircraft buyers are usually impressed with Price, Range, Speed and Cabin Size. After consideration of the Price, Range, Speed and Cabin Size, we can conclude that the Falcon 2000 displays a high level of productivity, which comes at a cost.

CHART G: Dassault Falcon 2000 vs Gulfstream G200 Productivity Comparison

The Dassault Falcon 2000 shows a higher retail price (comparing 2006 preowned models), but offers greater productivity compared to the Gulfstream G200. The Gulfstream G200 has a very large operating cost advantage, and longer range than the Falcon 2000. But the Falcon 2000 offers a greater cabin volume and a much higher payload with full fuel capability.

Operators should weigh up their mission requirements precisely when picking which option is the best for them.

Summary

Within the preceding paragraphs we have touched upon several of the attributes that business aircraft operators value. There are other qualities such as airport performance, terminal area performance, and time to climb that might factor in a buying decision.

The used Falcon 2000 and Gulfstream G200 show good monthly full retail sale transactions, averaging three units per month, and are clearly still very popular models on the pre-owned market.

Operators in the market should find the preceding comparison useful. Our expectations are that both business jets will continue to do well on the market for the foreseeable future.

Find Dassault Falcon 2000 and Gulfstream G200 jets for sale on AvBuyer.