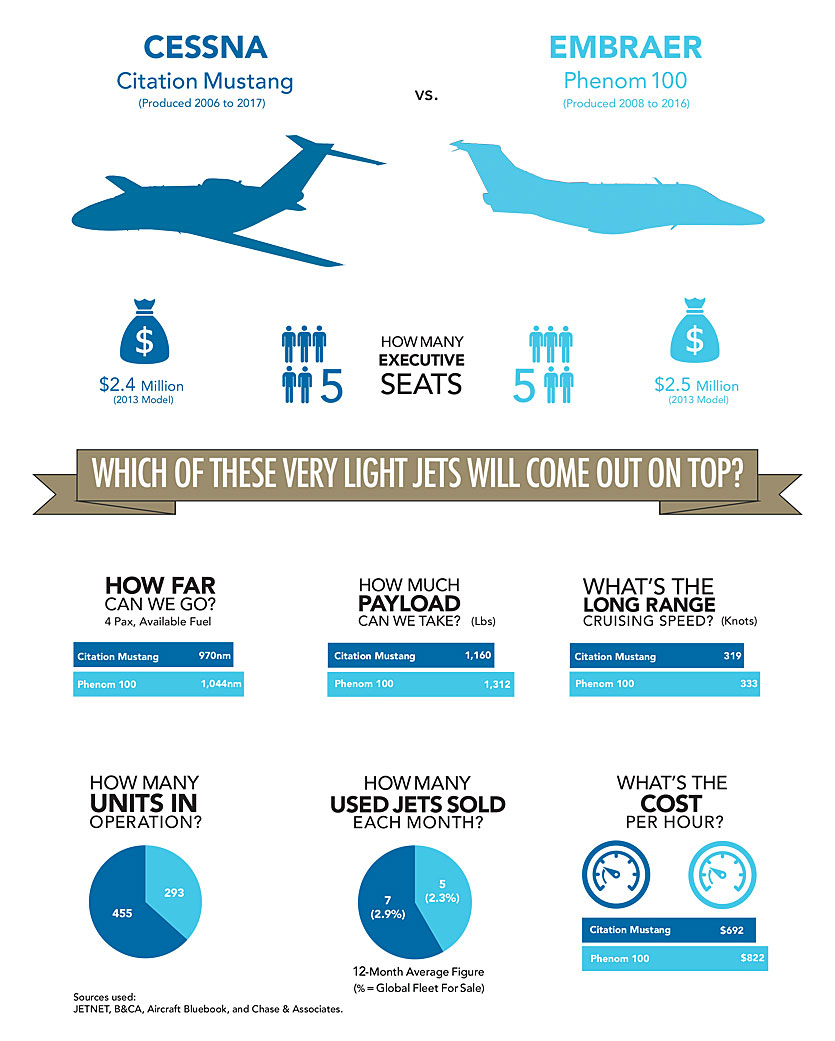

Over the following paragraphs we’ll consider key productivity parameters for the Cessna Citation Mustang and the Embraer Phenom 100 (including payload, range, speed, and cabin size) to establish which aircraft provides the better value in the Very Light Jet market.

With re-owned business jet inventory in very limited supply at the time of writing, we found that there has been a doubling of the number of used Embraer Phenom 100 transactions, from an average of three per month in 2020 to six in 2021. The Citation Mustang has not recorded a similar change, with monthly transactions rising from six in 2020, to seven in 2021.

We decided to explore further, comparing these jets side-byside to see if we could find an obvious reason for this.

Cessna Citation Mustang

The Cessna Citation Mustang was first announced in 2002, and was developed for entry level jet customers offering single-pilot capability. The first flight occurred in April 2005, and FAA Type Certification was received on September 8, 2006.

Powered by two Pratt & Whitney PW615F turbofan engines, the Mustang’s cockpit incorporates the all-glass Garmin G1000 avionics system. The jet proved to be a hit with the market, and Cessna produced 479 units before bringing production to an end in 2017.

At the time of writing, there were 455 wholly-owned Citation Mustang business jets in operation around the world, with a further 16 in shared ownership, and one in fractional ownership, per JETNET data. Ninety-eight aircraft remained with their original owner at the time of writing, and 374 have been sold on the used market. Seven Mustangs had been retired to date.

North America had the largest Mustang fleet percentage (62%), followed by Europe (22%) and South America (7%), for a combined total of 91% of the worldwide fleet. Just 2.9% of the fleet was available for sale as of this writing, with 61.5% under an exclusive broker agreement, and the average days on market just over 60 days, according to JETNET.

Embraer Phenom 100

The Phenom 100 was approved by the Embraer board in 2005, and reached the market in 2008, being produced until 2016. From 2013, Embraer began offering the enhanced Phenom 100E, and a further upgrade sees the Phenom 100EV delivered new to customers today.

Like the Citation Mustang, the Phenom 100 is certified for single pilot operations, and it derives its power from a pair of Pratt & Whitney PW617-F-E engines. The cockpit incorporates Embraer’s Prodigy Flight Deck, utilizing the Garmin G1000 avionics suite.

Having produced 308 units over the production run, as of this writing, 263 Phenom 100s are wholly-owned, according to JETNET, with 10 units in fractional and 20 in shared ownership for a total of 293 jets in operation worldwide. Thirteen have been retired and two are at the manufacturer.

The majority of the fleet is based in North America, where there were 153 (58%) units as of this writing. Just 2.4% of the fleet was available for sale, with 71.4% under an exclusive broker agreement. The average days on the market stood at 45 days.

How much do the jets cost?

Cessna Citation Mustang

$2.4 m

Embraer Phenom 100

$2.5 m

Cessna Citation Mustang

1,160 lbs

Embraer Phenom 100

1,312 lbs

Cessna Citation Mustang

5

Cessna Citation Mustang

970 nm

Embraer Phenom 100

1,044 nm

What's the long range cruising speed

Cessna Citation Mustang

319 knots

Embraer Phenom 100

333 knots

Cessna Citation Mustang

US$692

Embraer Phenom 100

US$822

Over the following paragraphs we’ll consider key productivity parameters for the Cessna Citation Mustang and the Embraer Phenom 100 (including payload, range, speed, and cabin size) to establish which aircraft provides the better value in the Very Light Jet market.

With pre-owned business jet inventory in very limited supply at the time of writing, we found that there has been a doubling of the number of used Embraer Phenom 100 transactions, from an average of three per month in 2020 to six in 2021. The Citation Mustang has not recorded a similar change, with monthly transactions rising from six in 2020, to seven in 2021.

We decided to explore further, comparing these jets side-byside to see if we could find an obvious reason for this.

Cessna Citation Mustang

The Cessna Citation Mustang was first announced in 2002, and was developed for entry level jet customers offering single-pilot capability. The first flight occurred in April 2005, and FAA Type Certification was received on September 8, 2006.

Powered by two Pratt & Whitney PW615F turbofan engines, the Mustang’s cockpit incorporates the all-glass Garmin G1000 avionics system. The jet proved to be a hit with the market, and Cessna produced 479 units before bringing production to an end in 2017.

At the time of writing, there were 455 wholly-owned Citation Mustang business jets in operation around the world, with a further 16 in shared ownership, and one in fractional ownership, per JETNET data. Ninety-eight aircraft remained with their original owner at the time of writing, and 374 have been sold on the used market. Seven Mustangs had been retired to date.

North America had the largest Mustang fleet percentage (62%), followed by Europe (22%) and South America (7%), for a combined total of 91% of the worldwide fleet. Just 2.9% of the fleet was available for sale as of this writing, with 61.5% under an exclusive broker agreement, and the average days on market just over 60 days, according to JETNET.

Embraer Phenom 100

The Phenom 100 was approved by the Embraer board in 2005, and reached the market in 2008, being produced until 2016. From 2013, Embraer began offering the enhanced Phenom 100E, and a further upgrade sees the Phenom 100EV delivered new to customers today.

Like the Citation Mustang, the Phenom 100 is certified for single pilot operations, and it derives its power from a pair of Pratt & Whitney PW617-F-E engines. The cockpit incorporates Embraer’s Prodigy Flight Deck, utilizing the Garmin G1000 avionics suite.

Having produced 308 units over the production run, as of this writing, 263 Phenom 100s are wholly-owned, according to JETNET, with 10 units in fractional and 20 in shared ownership for a total of 293 jets in operation worldwide. Thirteen have been retired and two are at the manufacturer.

The majority of the fleet is based in North America, where there were 153 (58%) units as of this writing. Just 2.4% of the fleet was available for sale, with 71.4% under an exclusive broker agreement. The average days on the market stood at 45 days.

Payload Comparison

When comparing business jets, an important area for potential operators to focus on is payload capability, and especially the ‘Available Payload with Maximum Fuel’.

Table A shows the Embraer Phenom 100’s ‘Available Payload with Maximum Fuel’ to be 580lbs, which is marginally more than the 560lbs offered by the Citation Mustang.

Table A: Cessna Citation Mustang vs Embraer Phenom 100 Payload Comparison

Cabin Comparison

As shown in Chart A, the cabin height, and width offered by the Phenom 100 are greater than the Citation Mustang, as is the length. These result in more overall cabin volume (212cu.ft versus 163cu.ft) in favor of the Phenom 100, accounting for the main seating area, but excluding the lavatory.

Configured with executive seating, each aircraft provides room for five seats with one crew. The Phenom 100 also provides greater internal and external luggage volume (10cu.ft and 60cu.ft, respectively) than the Citation Mustang (6cu.ft and 57cu.ft., respectively).

Chart A: Cessna Citation Mustang vs Embraer Phenom 100 Cabin Comparison

Range Comparison

Using Wichita, Kansas, as the start point, Chart B shows the Phenom 100 has a range of 1,044nm with four passengers and available fuel, which is 74nm greater than the Citation Mustang at 970nm.

Note: For business jets, ‘Four Pax Range’ represents the maximum IFR range of the aircraft at long range cruise. The NBAA IFR fuel reserve calculation is for a alternate. This range does not include winds aloft or any other weather-related obstacles.

Chart B: Cessna Citation Mustang vs Embraer Phenom 100 Range Comparison

Powerplant Details

As mentioned above, the Cessna Citation Mustang has two Pratt & Whitney engines producing 1,460lbst each. These burn 87 gallons per hour of fuel. By comparison, the Embraer Phenom 100 has two Pratt & Whitney PW617F-E engines, providing 1,730lbst each, and burning 106 gallons per hour of fuel.

Cost per Mile Comparison

Chart C details the ‘Cost per Mile’ of each jet, factoring direct costs and with each flying a 600nm mission with 800lbs (four passengers) payload. As shown, the Phenom 100 has a lower cost per mile at $2.76 per nautical mile, which is 12.4% less than the Citation Mustang ($3.15).

Chart C: Cessna Citation Mustang vs Embraer Phenom 100 Cost Per Mile Comparison

Variable Cost Comparison

The ‘Variable Cost’, illustrated in Chart D, is defined as the estimated cost of fuel, Maintenance labor, scheduled parts, and miscellaneous trip expenses (e.g., hangar, crew and catering). The Citation Mustang ($692/hr) has a lower variable cost than the Phenom 100 ($822/hr) – a difference of $130 (15.8%) in favor of the Citation Mustang.

These costs DO NOT represent a direct source into every flight department and their trip support expenses. For comparative purposes, the costs presented are the relative differences, not the actual differences since these may vary from one flight department to another.

Chart D: Cessna Citation Mustang vs Embraer Phenom 100 Variable Cost Comparison

Market Comparison Table

Table B contains the 2013 used prices (per Aircraft Bluebook, Spring 2022) for the Citation Mustang and the Phenom 100.

These are $2.4m and $2.5m, respectively. Also listed are the long-range cruise speed and range numbers (per B&CA), while the number of aircraft in-operation, the percentage for sale, and average sold per month are from JETNET.

There were 11 (2.9%) of the 455 Citation Mustangs ‘for sale’, and just five (2.3%) of 293 Phenom 100 ‘for sale’ at the time of writing. The average monthly used transactions over the previous 12 months were seven for the Citation Mustang and five for the Phenom 100 (down from six at the end of 2021).

Table B: Cessna Citation Mustang vs Embraer Phenom 100 Market Comparison

Maximum Scheduled Maintenance Equity

Chart E and Chart F display the Citation Mustang and Phenom 100 respectively. They depict (and project) the Maximum Maintenance Equity each jet has available based on its age.

The Maximum Maintenance Equity figure was achieved the day an aircraft came off the production line (since it had not accumulated any utilization toward any maintenance events). The percent of the Maximum Maintenance Equity that an average aircraft will have available, based on its age, assumes:

- Average annual utilization of 230 flight hours (in the case of the Mustang), and 325 flight hours (in the case of the Phenom 100); and

- All maintenance is completed when due.

Cessna Citation Mustang (Chart E) & Embraer Phenom 100 (Chart F) Average Maximum Maintenance Equity

Depreciation Schedule

Aircraft that are owned and operated by businesses are often depreciable for income tax purposes under the Modified Accelerated Cost Recovery System (MACRS). Under MACRS, taxpayers can use accelerated depreciation of assets by taking a greater percentage of the deductions during the first few years of the applicable recovery period.

In certain cases, aircraft may not qualify under the MACRS system and must be depreciated under the less favourable Alternative Depreciation System (ADS), based on a straight-line method meaning that equal deductions are taken during each year of the applicable recovery period. In most cases, recovery periods under ADS are longer than recovery periods available under MACRS.

There is a variety of factors that taxpayers must consider in determining if an aircraft may be depreciated, and, if so, the correct depreciation method and recovery period that should be utilized. For example, aircraft used in charter service (i.e. Part 135) are normally depreciated under MACRS over a seven-year recovery period, or under ADS using a twelve-year recovery period.

Aircraft used for qualified business purposes, such as Part 91 business use flights, are generally depreciated under MACRS over a period of five years or by using ADS with a seven-year recovery period. There are certain uses of the aircraft, such as non-business flights, that may have an impact on the allowable depreciation deduction available in any given year.

The US enacted the 2017 Tax Cuts & Jobs Act into law on December 22, 2017. Under the Act, taxpayers may be able to deduct up to 100% of the cost of a new or pre-owned aircraft purchased and placed in service before January 1, 2023.

This 100% expensing provision is a huge bonus for aircraft owners and operators. After December 31, 2022 the Act decreases the percentage available each year by 20% to depreciate qualified business jets until December 31, 2026.

Table C depicts an example of using the MACRS schedule for a 2013 model Citation Mustang in private (Part 91) and charter (Part 135) operations over five- and seven-year periods.

Table D depicts an example of using the MACRS schedule for a 2013 Phenom 100 in private (Part 91) and charter (Part 135) operations over five- and seven-year periods.

Cessna Citation Mustang (Table C) & Embraer Phenom 100 (Table D) showing Sample MACRS Depreciation Schedules

Asking Prices & Quantity

As a snapshot, there were 11 Citation Mustang business jets available for sale on the used aircraft market at the end of February 2022 with five showing there were sales pending.

The asking prices ranged from a high of $2.5m to a low of $1.25m, per JETNET data. Of course, the ‘For Sale’ market is a moving target. Two more aircraft had been added for sale by March 11, 2022.

While each aircraft serial number is unique, the Airframe Total Time (AFTT) and age/condition will cause great variation in the price of a specific aircraft – even between two aircraft from the same year of manufacture.

This can be seen in the fact the two price extremities listed above are both for 2010-model Citation Mustangs... The $2.5m Citation Mustang had just 679 hours Airframe Total Time and had been on the market for 166 days. The $1.25m Mustang had amassed 3,489 hours Airframe Total Time but had been on the market for 61 days.

Meanwhile, there were only five Embraer Phenom 100s available for sale on the used market at the end of February 2022. Two more had been added by March 11, 2022. As of March 11, two of the jets had a sale pending. Four, including the two with the sale pending, invited inquiries. Two invited offers from interested buyers, while the remaining jet on the market had an ask price of $3.8m.

Productivity Comparison

The points in Chart G are centered on the same aircraft. Pricing used in the horizontal axis is as published in Aircraft Bluebook. The productivity index requires further discussion since factors used can be somewhat arbitrary. Productivity can be defined (and it is here) as the multiple of three factors:

1. Four Passenger Range (nm) with available fuel

2. The long-range cruise speed flown to achieve that range

3. The cabin volume available for passengers and amenities

Chart G: Cessna Citation Mustang vs Embraer Phenom 100 Productivity

Others may choose different parameters, but serious business aircraft buyers are usually impressed with price, range, speed, and cabin size.

The Embraer Phenom 100 offers greater speed and slightly longer range than the Cessna Citation Mustang. Moreover, its ‘Available Payload with Maximum Fuel’ and cabin volume is greater than the Citation Mustang.

According to Aircraft Bluebook, the price of a 2013-model Cessna Citation Mustang is slightly lower ($2.4m vs $2.5m), and the Mustang has a lower hourly variable operating cost.

Prospective buyers of a Very Light Jet would have to weigh the capabilities of each very carefully against their specific mission, alongside their operating budget to determine which is the best fit for their flight operations. If the higher cabin comfort and range capability of the Embraer Phenom 100 are attractive, are they justifiable when weighted against the extra cost?

An added factor that may weight a decision over whether to buy one model over the other could be the production status of an aircraft. Both the Citation Mustang and Embraer Phenom 100 are no longer in production, but whereas Embraer enhanced the Phenom 100 with the Phenom 100E and then the 100EV model, Cessna didn’t produce an upgraded model.

This could be one of several reasons to speculate why monthly sales of pre-owned Phenom 100 jets increased dramatically, while Citation Mustang sales didn’t.

Within these paragraphs we have touched upon several of the attributes that business jet operators value, although there are other qualities, such as airport performance, terminal area performance and time-to-climb that might factor in a buyer’s choice.

These should all highlight that selection of one aircraft over another is rarely a clear-cut decision, and should be undertaken with expert industry advice and guidance.

Find Cessna Citations and Embraer Phenom Very Light Jets for Sale on AvBuyer.