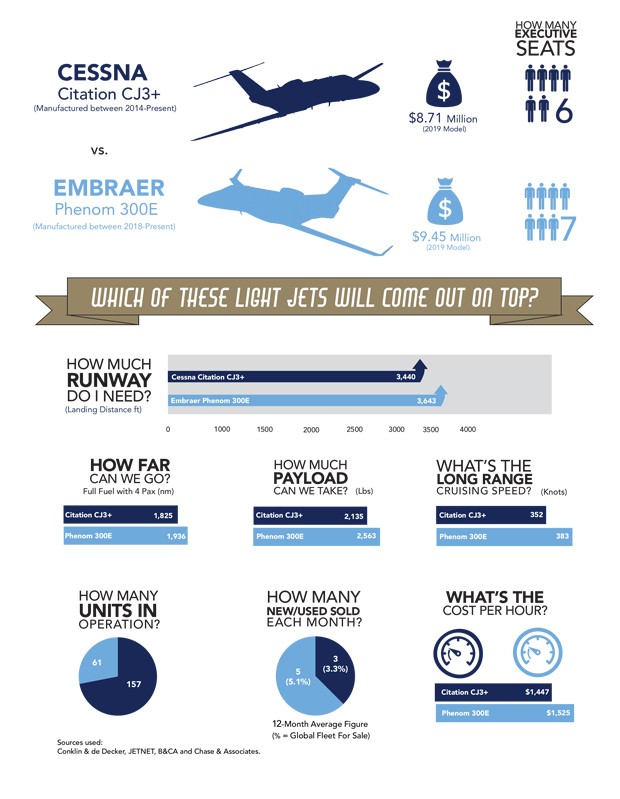

Over the following paragraphs we’ll consider key productivity parameters for the Cessna Citation CJ3+ and the Embraer Phenom 300E (including payload, range, speed and cabin size) to establish which aircraft provides the better value in the Light Jets for sale market.

The original Citation CJ3 received full FAA type certification in October 2004 and ended production a decade later in 2014 when the Cessna Citation CJ3+ was introduced. The CJ3+ continues to be produced today. The Citation CJ3+, like its predecessor, is permitted to operate with a single pilot (US registry only).

When Cessna developed the model, the cabin was stretched an additional two feet compared to the smaller CJ2 model, and the wingspan was widened by three feet. The economy of the fuel burn associated with the CJ3+ can be largely attributed to Cessna’s choice of engines. Two Williams FJ44-3A turbofan powerplants are utilized.

Of the 149 Wholly-Owned Citation CJ3+ jets in operation at the time of writing, North America housed the largest fleet percentage (87%) followed by Europe (9%). Together, they account for a combined 96% of the world’s CJ3+ fleet.

Embraer Phenom 300E

Embraer’s original Phenom 300 model received FAA Type Certification in December 2009. The Phenom 300 enjoyed several years as the best-selling jet before, in 2017, the Embraer Phenom 300E was introduced.

The first Embraer Phenom 300Es were delivered to customers in early 2018 and offered a new interior design and improved (Prodigy Touch) avionics, utilizing the Garmin 3000 suite. Meanwhile, like the Phenom 300, the Phenom 300E is powered by a pair of Pratt & Whitney Canada PW535E turbofans.

Of the 68 Wholly -owned Phenom 300Es in operation at the time of writing, North America was home to the largest fleet percentage (73%) followed by Europe (13%) and South America (9%). Together, these regions accounted for a combined 95% of the world’s Phenom 300E fleet.

Payload & Range Comparison

When comparing business aircraft, an important area for potential operators to focus on is the payload capability, and especially the ‘Available Payload with Maximum Fuel’.

Table A shows the Citation CJ3+ ‘Available Payload with Maximum Fuel’ to be 820lbs, which is considerably less than the 1,487lbs offered by the Embraer Phenom 300E.

TABLE A: Cessna Citation CJ3+ vs Embraer Phenom 300E Payload Comparison

Cabin Cross-Section Comparison

Meanwhile, Chart A depicts the cabin cross-sections of the Embraer Phenom 300E and Cessna Citation CJ3+. As shown, the Phenom 300E has more cabin height and width compared to the Citation CJ3+. The Phenom 300E also has a greater cabin length than the Citation CJ3+ (17.2ft vs 15.67ft).

CHART A: Cessna Citation CJ3+ vs Embraer Phenom 300E Cabin Cross-Section Comparison

Overall, the Phenom 300E provides slightly more cabin volume (324cu.ft.) than the CJ3+ (286cu.ft.). In terms of baggage provision, while the Phenom 300E provides virtually the same internal luggage volume as the CJ3+ (66cu.ft. versus 65cu.ft.), the Phenom 300E offers an additional 19cu.ft. external space, and the Citation CJ3+ has none.

Range Comparison

As depicted in Chart B, using Wichita, Kansas as the start point the Cessna Citation CJ3+ offers slightly less range coverage (1,825nm) than the Embraer Phenom 300E at 1,936nm, each flying with four passengers and available fuel.

CHART B: Cessna Citation CJ3+ vs Embraer Phenom 300E Range Comparison

Note: For business jets, ‘Four Pax Range’ represents the maximum IFR range of the aircraft at long range cruise. NBAA IFR fuel reserve calculation is for a 200nm alternate. This range does not include winds aloft or any other weather-related considerations.

Variable Cost Comparison

Two Williams FJ44-3A engines power the Citation CJ3+, each providing 2,820lbst and burning 133 gallons per hour (gph). By comparison, the Embraer Phenom 300E is powered by a pair of Pratt & Whitney Canada PW535E engines, each offering 3,360lbst and burning 152gph.

The ‘Variable Cost’, illustrated in Chart C, is defined as the estimated cost of fuel expense, maintenance labor expense, scheduled parts expense and miscellaneous trip expense (hangar, crew and catering).

CHART C: Cessna Citation CJ3+ vs Embraer Phenom 300E Variable Cost Comparison

These costs DO NOT represent a direct source into every flight department and their trip support expenses. For comparative purposes, the costs presented are the relative differences, not the actual differences since these may vary from one flight department to another.

The Citation CJ3+ shows a lower variable cost at $1,447/hr compared to the Embraer Phenom 300E ($1,525/hr) – a 5.4% difference.

Market Comparison Table

Table B contains the new prices (per B&CA) for a 2019 model Cessna Citation CJ3+ and Embraer Phenom 300E. The long-range cruise speeds and range numbers are also from B&CA. The cabin volumes, the number of aircraft in operation, the percentage for sale, and average sold are from JETNET.

TABLE B: Cessna Citation CJ3+ vs Embraer Phenom 300E Market Comparison

The Citation CJ3+ had 3.3% of its fleet for sale on the used aircraft market at the time of writing, while 5.1% of the Embraer Phenom 300E fleet were for sale. The average number of new and used transactions (units sold) per month over the previous 12 months for the Citation CJ3+ is three, compared to five for the Embraer Phenom 300E.

Maximum Scheduled Maintenance Equity

Chart D and Chart E display the Cessna Citation CJ3+ and Embraer Phenom 300E respectively, and project the Maximum Maintenance Equity each jet has available, based on aircraft age.

- The Maximum Maintenance Equity figure is achieved the day an aircraft comes off the production line (since it has not accumulated any utilization toward any maintenance events).

- The percent of the Maximum Maintenance Equity that an average aircraft will have available, based on its

age, assumes:

- Average annual utilization of 320 flight hours (in the case of the CJ3+) and 300 flight hours (in the case of the Phenom 300E); and

- All maintenance is completed when due.

CHART D: Cessna Citation CJ3+ Maximum Maintenance Equity

CHART E: Embraer Phenom 300E Maximum Maintenance Equity

Depreciation Schedule

Aircraft that are owned and operated by businesses are often depreciable for income tax purposes under the Modified Accelerated Cost Recovery System (MACRS). Under MACRS, taxpayers can use accelerated depreciation of assets by taking a greater percentage of the deductions during the first few years of the applicable recovery period (see Table C).

TABLE C: Modified Accelerated Cost Recovery System Schedule (Part 91 & Part 135)

In certain cases, aircraft may not qualify under the MACRS system and must be depreciated under the less favourable Alternative Depreciation System (ADS), based on a straight-line method meaning that equal deductions are taken during each year of the applicable recovery period. In most cases, recovery periods under ADS are longer than recovery periods available under MACRS.

There is a variety of factors that taxpayers must consider in determining if an aircraft may be and if so, the correct depreciation method and recovery period that should be utilized. For example, aircraft used in charter service (i.e. Part 135) are normally depreciated under MACRS over a seven-year recovery period, or under ADS using a twelve-year recovery period.

Aircraft used for qualified business purposes, such as Part 91 business use flights, are generally depreciated under MACRS over a period of five years or by using ADS with a six-year recovery period. There are certain uses of the aircraft, such as non-business flights, that may have an impact on the allowable depreciation deduction available in any given year.

The US enacted the 2017 Tax Cuts & Jobs Act into law on December 22, 2017. Under this Act, taxpayers may be able to deduct up to 100% of the cost of a new or pre-owned aircraft purchased after September 27, 2017 and placed in service before January 1, 2023.

This 100% expensing provision is a huge bonus for aircraft owners and operators. After December 31, 2022 the Act decreases the percentage available each year by 20% to depreciate qualified business jets until December 31, 2026.

Table D depicts an example of using the MACRS schedule for a 2019-model Citation CJ3+ in private (Part 91) and charter (Part 135) operations over five- and seven-year periods.

TABLE D: Example Cessna Citation CJ3+ MACRS Schedule

Table E depicts an example of using the MACRS schedule for a 2019-model Embraer Phenom 300E in private (Part 91) and charter (Part 135) operations over five- and seven-year periods.

TABLE E: Example Embraer Phenom 300E MACRS Schedule

Asking Prices & Quantity

The two Phenom 300E business jets available on the used aircraft market at the time of writing showed asking prices of $8.8m and $9.95m (the latter price being greater than the B&CA 2019 model price). By comparison, eight Cessna Citation CJ3+ jets were for sale, and three showed asking prices ranging from $6.195m to $7.295m.

While each serial number is unique, the Airframe Total Time (AFTT) and age/condition of an aircraft will cause variation in the pricing of specific aircraft – even between two aircraft from the same year of manufacture. The final negotiated price remains to be decided between the seller and buyer before the sale of an aircraft is completed.

Citation CJ3+ vs Phenom 300E Productivity Comparison

The points in Chart F are centered on the Citation CJ3+ and Embraer Phenom 300E. Pricing used in the vertical axis is as published in B&CA. The productivity index requires further discussion in that the factors used can be somewhat arbitrary. Productivity can be defined (and it is here) as the multiple of three factors:

- Four Passenger Range (nm) with available fuel;

- The long-range cruise speed flown to achieve that range; and

- The cabin volume available for passengers and amenities.

Others may choose different parameters, but serious business aircraft buyers are usually impressed with price, range, speed and cabin size.

CHART F: Cessna Citation CJ3+ vs Embraer Phenom 300E Productivity Comparison

In Summary

The Embraer Phenom 300E has a higher price than a Citation CJ3+ ($9.45m vs $8.75m), and the Citation CJ3+ exhibits a lower hourly variable operating cost but with a lower long-range cruise speed (352kts vs 383kts) and significantly lower Available Payload with Full Fuel (820lbs vs 1,487lbs).

Moreover, the Embraer Phenom 300E offers a larger cabin volume, and longer range with four passengers.

Within the preceding paragraphs we have touched upon several of the attributes that business jet operators value. There are other qualities such as airport performance, terminal area performance and time to climb that might factor in a buying decision, however.

This month’s comparison highlights where the line might be for an operator needing slightly more capability in a jet (Phenom 300E) or slightly less capability (Citation CJ3+), and approximately what that increase in capability might cost (in terms of variable operating and acquisition costs). Operators should weigh up their mission requirements precisely when picking which option is the best for them.

Ultimately, there is plenty for a prospective buyer to consider when choosing the right aircraft for their mission needs. Both of this month’s featured business jets offer great value in the Light Jets for sale market today for the savvy buyer who has their mission needs well defined.

Read More:

For more information on the Cessna Citation CJ3, please see our CJ3 Jet Price and Buyers Guides by AvBuyer editor, Matt Harris.